On Monday Don Elder the Chief Executive of New Zealand's Solid Energy confirmed that a major restructuring of the NZ coal miner would require closure of the Spring Creek underground mine and the loss of 460 jobs over the company.

This move had been signaled in advance, but it is still making most news broadcasts today. Elder attributes the need to downsize to trends in international coal prices. For example Elder told Radio New Zealand;

an unforeseen, and dramatic, global price crash had rocked the industry.The new chair of the board of directors, Mark Ford, said in a press release;

"In the second week of July the markets tanked, demand fell through the floor," he said. In up to six weeks the price plummeted 40 to 50 percent and did not show any sign of bouncing back anytime soon."

“The price for Spring Creek’s semi-soft coking coal would need to be somewhere from NZ$180-200 a tonne for the operation to deliver a profit and pay off the investment made in it,” Mr Ford said. “International semi-soft contracts are now being made at around NZ$120 a tonne.”

New Zealand PM John Key seems to have accepted the Elder view that prices are to blame.

"The issue isn't that we're not on their side, the issue is that international coal prices aren't on their side.""In the case of Solid Energy it's a victim of falling commodity prices."

The NZ media seem to have uncritically accepted the price explanation. In one story, Fairfax reported the reason for the mine closure and job losses as being due to a severe downturn in global coal prices

Not so, "Chalkie", of the Fairfax NZ business section. "Chalkie" took Solid Energy to task for blaming their troubles entirely on the international coal price. Chalkie also satirised Elder's cornucopian Think Big-style lignite and coal-gas proposals.

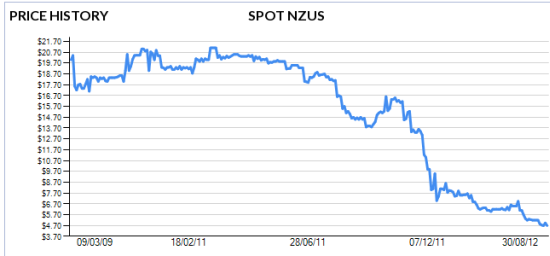

Chalkie says he doesn't believe Elder has credibility when he says current coal prices in NZ$ are 20% lower than at the bottom of the 2008 global financial crisis. Chalkie points out that Elder's quoting of a coal price of $330 USD per tonne, as the top of the price mountain that the price has now fallen off, is just unrealistic.

In June 2011, a record price of $US330 a tonne for Australian hard coking coal, was reached because of supply shortages following the January 2011 Queensland floods which drowned most of Queensland's coal mines.

Chalkie also notes that a coking coal price of $USD126 a tonne is still well above the norm before the GFC. I have complied some prices for Australian hard coking coal. Data at Google Docs. Coking or metallurgical coal is used in steel making, and usually trades at a premium price above 'thermal' coal supplied to power stations. I prepared a chart of prices per tonne in $USD from 2006 to 2012. Spring Creek Mine coal is 'semi-soft' coking coal, which I think means its price is not quite the same as coking coal, but still more than thermal coal.

The post Queensland flood price of $USD330 a tonne sticks out as a spike or outlier as does the 2008 high of $USD250 tonne, which also followed a La Nina mine flooding event. Coal producers might not want to know about global warming, but global warming certainly knows about Queensland's coal mines.

And here is a chart of 2012 monthly hard coking prices in $USD. The data.

The price for Aussie had coking coal has fallen consistently in 2012. However,there is no cliff the price has fallen off in July 2012. The hard coking coal price did not plummet 40 to 50 percent in 6 weeks as Dr Elder says. The price trend is neither "unforeseen" nor "dramatic" and nor is it a "crash".

It's not hard to find reasons for the decline in the price. of coal. Reuters reports a number of reasons. Demand for coal is down in China. While the floods stopped the Aussie supply, steel makers looked to substitute other suppliers. Mongolia is increasingly eating into Australia's share of coal exports to China.

Chalkie also notes that the Huntly East underground mine has had some safety issues. Work to install a $NZ40 million ventilation tunnel, the sort of thing Dr Elder criticised Pike River Coal for not having, stopped in August 2012. Could it be that Solid Energy is using the international coal price as an excuse to avoid spending the money needed to make its underground mines as safe as the public now expect in a post-Pike River Coal disaster world?

Chalkie also notes a "field of dreams" approach to the Taupo wood pellet plant, (later written down in value by $NZ30 million) and delays in the Mataura lignite briquette plant. Given the execution of these smaller projects, Chalkie questions Solid Energy's ability to deliver on the grander lignite conversion plans.

I will leave the last word to Chalkie.

Every day at 8.30am sharp, management at Solid Energy would gather for morning prayers at the company shrine.

The small room was dominated by a huge gleaming slab of coking coal, etched with phrases from an early foreign exchange hedge contract. The dozens of executives stood facing it, arms by their sides, palms turned towards the slab in unison.

It was always a brief, uplifting affair. The CEO would begin with a chant: "Every day in every way, we expect coal prices to rise."

The executives would respond: "And rise they shall."

CEO: "With wood pellets and lignite we will rule."

Response: "Nothing bad will happen."

CEO: "Our big ideas are worth squillions."

Response: "Yes, probably more."

CEO: "Gentlemen, make it so."

And with that they would shuffle out shiny-cheeked into the morn.

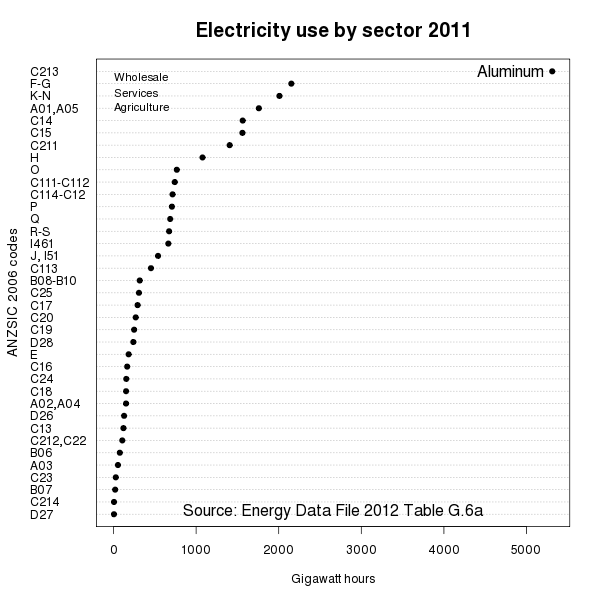

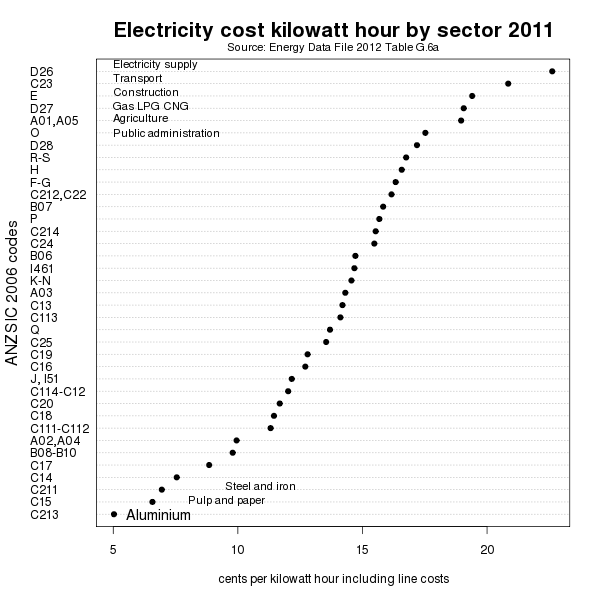

Robin Johnson's Economics Web Page argues that Rio Tinto-owned New Zealand Aluminium Smelters Ltd, the owner of the Tiwai Point aluminium smelter, is "Godfathering" the smelter, its workforce, the Southland economy, the NZ electricity market, Meridan Energy and the poor critically endangered slow-breeding kakapo, as well as "Godfathering" the NZ emissions trading scheme to get excessive free allocations of emissions units.

Robin Johnson's Economics Web Page argues that Rio Tinto-owned New Zealand Aluminium Smelters Ltd, the owner of the Tiwai Point aluminium smelter, is "Godfathering" the smelter, its workforce, the Southland economy, the NZ electricity market, Meridan Energy and the poor critically endangered slow-breeding kakapo, as well as "Godfathering" the NZ emissions trading scheme to get excessive free allocations of emissions units. And NZ Aluminium Smelter also wants to

And NZ Aluminium Smelter also wants to